Reach Your Growth Trap Escape Velocity

Avoid the Race to the Bottom From Accelerating Sales

You’ve probably heard—maybe even used—the saying that “Sales cures all.” But does it really?

Sometimes sales growth can spell trouble. The old formula of “lose it on the margin, make it up on the volume” can create an unfortunate situation where rapid growth can run a company out of money. Just like a car needs fuel to keep driving forward, a business needs efficient operations to sustain growth – regardless of market conditions. Without optimizing its operations, the faster a business grows, the faster it can run into financial trouble.

The problem is that many businesses don’t even realize they are in trouble until too late. Or, if they have realized it, they don’t know how to diagnose the cause(s) or fix it. At a time when the business should be accelerating and producing free cash flow — reaching what we termed growth trap escape velocity — leaders may find that growth continues to be tied to capital infusions. This article is the first in a series that provides leaders with a framework to identify whether their businesses have this problem, assess the root causes if they do, and determine how best to remediate the problem.

Understanding the Issue

Most business leaders know how to produce an income statement that tells them if they are making or losing money and identifies which buckets their cash flows into (labor, supplies, overhead, etc.). Yet, many businesses don’t understand the relationships that particular activities, customers, and/or products have with these expense buckets. Not knowing these relationships makes it difficult to know if selling one more unit of a product or service will add profits to the business or cost it more than it makes.

Of course, knowing whether the business is making or losing money on the marginal sale is the first step; it doesn’t tell you what is broken or how to fix it. For that, one needs to assess the business’ operational efficiency. Merriam-Webster Dictionary defines operational efficiency as "… the ability to deliver goods or services to customers with the least amount of wasted resources or effort." By determining how to improve operational efficiency, the company can ensure it is maximizing profits while also building a scalable foundation for continued growth.

Finding the issue

The existence of a performance issue should be a powerful motivator for leaders to put the business up on the rack and figure out how to fix it. Often though, knowing or even suspecting an issue is not enough to drive a business to do the work to find it; the reality is that effort diverts scarce resources companies tend to want to keep on existing activities. However, thoughtful, forward-looking leaders that take on this work will develop a better understanding of a business, which should reveal opportunities for revenue and/or margin improvement. Doing this hard work requires a partnership between finance and operations, the fortitude to look at all aspects of the business (especially the weaknesses and flaws), and the willingness to announce that the emperor has no clothes.

Finance

Diagnosing the existence and nature of an efficiency issue starts with the company’s financials. From a top-down perspective, the business’s financial systems and chart of accounts should be structured and implemented to capture all direct costs associated with delivering the company’s products or services. This approach will allow the business to see over time how gross margins are changing and correlate this to changes in revenue.

But this is just the starting point. The finance team needs to dig deeper into the major cost buckets (labor, materials, systems, etc.) to understand how these are moving in relation to each other and the changes in revenue and gross margins. The key here is understanding whether the changes are macro ones (e.g., price changes) not caused by the revenue changes or are directly correlated to the revenue changes.

Once the finance team isolates the cost drivers of the change, get to work with the operations to figure out the why.

Operations

The operations team needs to work closely with the finance team to understand the operational factors driving costs in the business. Begin by mapping out the operational processes for building, delivering, and supporting the products or services. There will not be a single universal process representing the flow of revenues and costs. Rather, your operations analysis will reveal a baseline process for each facet of operations and then variations on the process that cross variants of the products or services and customer segments. These processes span functions, connecting design, development, sales, delivery, and support of the products or services. Business process mapping tools such as the business model canvas can be useful for founders and leaders new to this activity. But pencil and paper or spreadsheet software can be just as useful. The most important tool is your brain and the collective knowledge of your team, where the real, detailed knowledge of the business often resides.

Identifying Opportunities

Once the processes have been all identified and mapped out, identify the core KPIs and incremental cost drivers that go into the steps of the process. The operations and finance teams work together closely to build out operational cost models for the business to understand where the business is making and losing money to prioritize the work of identifying:

Which product/customer pairs are delivering the most marginal cash to the business to focus the sales team on in the short term,

Which product/customer pairs are consuming the cash from the business to prioritize fixing or eliminating them, and

Which product/customer pairs where the smallest improvement can have the largest impact on the business’s cash flows?

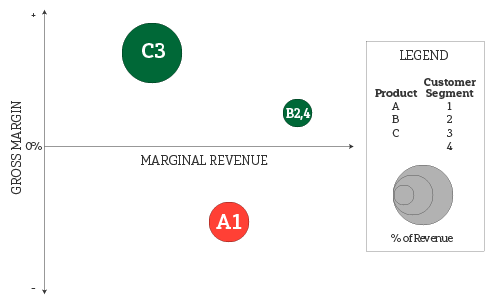

In the end, the operations mapping would reveal where the greatest investment leverage in your business resides. The diagram below is one type of analytical outcome from this process that provides insights into areas for future growth.

By considering operations and finance factors, your analysis will identify certain products or services that outperform on margin. In this example, product C serving customer segment 3 consistently delivers strong margins, but growth has slowed. Traditionally, these types of products were considered ‘cash cows.’ Today, they may represent opportunities for product extension and innovation if new pathways for growth can be conceived and tested. Or, they may be running into the end of their lifecycles.

By contrast, the product-customer combinations B2 and B4 may possess a potential for growth through execution. They are each experiencing higher relative sales growth, but margin impact has yet to appear. This positioning on the map above may also implicate issues with unit economics, market positioning, or operational inefficiencies. This product also bears further investigation.

The third product, A1, seems at first analysis to be past its prime. The operational focus here should be on opportunities for repackaging or retargeting the product, extracting organizational learning and innovation possibilities from its underlying design and technologies — what worked/what didn’t work — and sunsetting the product.

This mapping reveals opportunities for potential operational and development actions that can lead to greater financial performance. But only once the issues are diagnosed and remediated — topics for the next Operations Alchemy post.